| |

Egwald Economics: Macroeconomics

by

Elmer G. Wiens

Egwald's popular web pages are provided without cost to users.

Follow Elmer Wiens on Twitter:

Macroeconomics Theory, Testing, and Applications

Closed Canadian Economy Version | Open Canadian Economy Version | Comparative Statics of the Canadian IS-LM Model

Comparative Statics Of

The Basic Keynesian IS-LM Model

Closed Canadian Economy Version

consumers | producers | money demand | government

product market | money market | economy equilibrium

|

Shifting the Economy's Equilibrium.

Macroeconomic variables and aggregates, such as national income and product, consumers' expenditures and savings, producers' output of products and producers' investment in capital, government revenues (taxes) and expenditures, exports and imports, the level and composition (by age, sex, and region) of employment, and the quantity of money in circulation, fluctuate constantly.

Consumers changing their spending behaviour, firms investing more or less in capital as their expectations of profitable opportunities change, and the government adjusting the supply of money to accommodate variations in its expenditures and tax revenues are examples of shifts in the underlying parameters of the IS-LM model. Such changes in the parameters will induce a shift in the economy's equilibrium.

On this web page, I permit you to adjust the model's parameters to see how the equilibrium macroeconomic variables and aggregates change. For example, suppose the government decides to drastically curtail its expenditures. What does the IS-LM model predict will happen to the macroeconomic variables and aggregates?

The diagrams on this web page show the macroeconomic functions for the two systems and corresponding IS-LM equilibriums. I express all aggregates in billions of dollars.

System 1 (in blue): the parameters of the macroeconomic functions reflect the average values of the macroeconomic aggregates of the Canadian economy during the years of 2001 - 2003. Government expenditures g = 210 and the money supply ms = 200.

System 2 (in red): you set the parameters of the macroeconomic functions to whatever values you want, within limits. Try to replicate the macroeconomic aggregates for some year. Initially, I set government expenditures g = 170, and the money supply ms = 190.

Set the parameters for the consumers, producers, and the government as desired

and CLICK ON THE SUBMIT PARAMETERS BUTTON BELOW!

|

|

The Product (Commodity) Market Equilibrium.

|

|

The c + i + g curve as a function of r and y is:

System 1:

c + i + g = 427.5 + 0.746*y - 60*r + 2*r2

System 2:

c + i + g = 387.5 + 0.746*y - 60*r + 2*r2

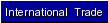

The IS Curve.

System 1:

y = 1683.07 - 236.22 * r + 7.87 * r2

System 2:

y = 1525.59 - 236.22 * r + 7.87 * r2

|

|

The Money Market Equilibrium.

|

|

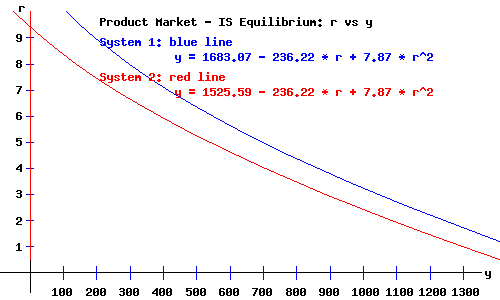

The LM Curve.

The LM curve, y as a function of the rate of interest r, is:

System 1:

y = 543.48 + 152.17 * r - 6.52 * r2

System 2:

y = 500 + 152.17 * r - 6.52 * r2

|

|

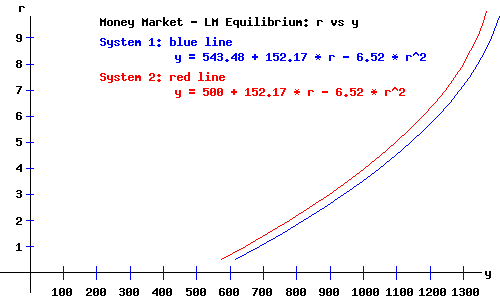

The IS-LM Demand Equilibrium.

|

|

Economy Equilibrium Macroeconomic Variables and Aggregates

|

| |

System 1

|

System 2

|

|

National Income: y

|

980.08

|

894.07

|

|

Rate of Interest: r

|

3.35

|

2.97

|

|

Disposable National Income: yd

|

789.46

|

722.37

|

|

Consumer Expenditures: c

|

591.23

|

550.73

|

|

Firm Investments: i

|

178.85

|

173.34

|

|

Government Expenditures: g

|

210

|

170

|

|

Government Revenue: t

|

190.62

|

171.7

|

|

Money Supply: ms

|

200

|

190

|

|

Consumer Savings: s = yd - c

|

198.23

|

171.65

|

|

Works Cited and Consulted

-

Akerlof, George A. "The Missing Motivation in Macroeconomics." Presidential Address, AEA, January, 2007.

-

Branson, William H. and James M. Litvack. Macroeconomics. New York: Harper, 1976.

- Crouch, Robert L. Macroeconomics. New York: Harcourt, 1972.

- Darby, Michael. Macroeconomics. New York: McGraw-Hill, 1976.

-

Dornbusch, Rudiger. Open Economy Macroeconomics. New York: Basic, 1980.

-

Dornbusch, Rudiger, Stanley Fischer, and Gordon Sparks. Macroeconomics, 1st. Canadian Edition. Toronto: McGraw-Hill, 1982.

- Laidler, David E. W. The Demand For Money: Theories and Evidence. Scranton, Penn.: International Textbook, 1969.

- Parkin, Michael, and Robin Bade. Macroeconomics. 4th ed. Toronto: Addison Wesley, 2000.

|

|